Become A Resolution Applicant

The Insolvency and Bankruptcy Law, 2016 ('IBC'), was implemented with the intention of reorganizing and addressing the insolvency of private entities that are unable to pay their creditors in a time-limited manner.

Become A Resolution Applicant

The Insolvency and Bankruptcy Law, 2016 (‘IBC’), was implemented with the intention of reorganizing and addressing the insolvency of private entities that are unable to pay their creditors in a time-limited manner.

In fact, the goals of the IBC include:-

- Maximizing the value of corporate assets.

- To foster entrepreneurship.

- Availability of the loan.

- Balance of interests amongst all parties

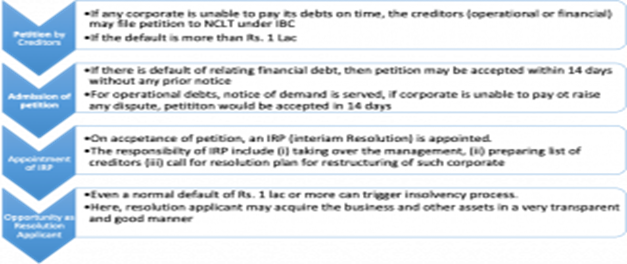

IBC Process, As A Glance

Resolution Applicant, A New Opportunity

As shown above, upon acceptance of the IBC petition, an Interim Resolution Professional (‘IRP’ or RP’) is appointed to take over the management of the Corporate Person against whom insolvency proceedings have been initiated. The IRP then has the responsibility

- Public announcement for the submission of claims by all creditors (financial or operational)

- Preparation a list of all claims

- Scheduling of the Statement of Affairs

- Ask for a resolution plan

It is a resolution plan – the resolution plan is a plan formulated by the insolvency resolution applicant regarding a corporate debtor’s continuing concern.

How To Become A Resolution Applicant In The IBC?

Following an invitations from the IRP, any person qualified under the IBC can apply a resolution plan and become a resolution applicant. The resolution plan must be formulated on the basis of a memorandum of knowledge.

Through taking this chance to become a resolution candidate and submitting a resolution application, any company will benefit from those advantages. Few of them are listed below:-

A) Acquisition of a company – if entity is trying to buy on a particular enterprise value, there is an incentive for them to actually apply a realistic settlement strategy that allows them to take over the company that is operating and to have a full structure in place.

B) Penetrating into a different domain – if any company is trying to join a new domain or a new domain, it is easy for them to do so. The person only needs to apply a settlement proposal to the Settlement Specialist, and if it is approved then it would be easy for that company to enter such a new territory.

C going to promote entrepreneurship:- Becoming a resolution applicant is easy to get into business. Rather than starting from scratch, it will be easier for new entrants to invest a small amount and to acquire a potential business in the future.

D) Comparative low cost:- As long as the business is exposed to insolvency, the valuation of its reputation and even the costs of those goods are influenced by consumer sentiments. Therefore, there are certain intangible properties correlated with each company that lose their interest through the settlement process. On the basis of these points, the price proposed for resolution is much lower than the price requested by that party if it were not subject to insolvency.

E) Better understanding with creditors and stakeholders – The resolution proposal is approved by the creditors’ committee, which means that it would provide an understanding with creditors for the future.