SSI / MSI / LSI Registration Services

We are well aware with the process of SSI/ MSI/LSI registration. If you are looking forward to relevant guidance in this regard then you can contact us.

SSI / MSI / LSI Registration Services

What Is The Procedure For SSI Registration?

- PRC (Provisional Registration Certificate) is applicable to any item that does not require industrial license. It means items listed in Schedule-III and items not listed in Schedule-I or Schedule-II of the licensing Exemption Notification. Units with 50 or 100 workers are also eligible for registration along with the registration of items under Schedule II

- The unit can apply for PRC in the prescribed application form. PRC is issued without conducting field enquiry

- PRC is valid for a time period of 5 years. If the entrepreneur fails to operate business in the meanwhile, he can apply again after the completion of period.

- With the commencement of production by a unit, it is required of applying for permanent registration in the form prescribed.

- It has to obtain clearance whether statutory or administrative eg: NOC from Pollution Control Board (if required), drug license under drug control order,etc.

- At the time of evaluation, the unit should not violate any location restrictions in force

- Value of machinery and plants is within prescribed limits

- The unit is not controlled and owned by any other industry as per the notification

Benefits Of Provisional Registration Certificate (PRC)

- This is given for the pre-operative period and enables the units to obtain the term loans and working capital from financial institutions/banks under priority sector lending.

- Obtaining facilities for land, accommodation and other approvals

- Obtaining important NOCs from regulatory bodies like Labor Regulations and Pollution Control Board.

Requirement For Application Of SSI Registration

- The application has 3 sets which contain Applicant’s name & address, Company/Industries name & address, Cost of machinery, Name of product, cost of manufacturing item, list of documents attached with the application.

- Furnish lease/ rental agreement

- Submission of self-certified copy of board resolution, society resolution and power of Attorney.

- Submission of self-attested copy of partnership or memorandum deed and articles of association along with Incorporation certificate.

- Submit copy of PAN cards of the Company and the Directors

- Submit Company’s address proof– Electricity bill and Telephone bill, etc.

Provisional Registration Certificate

- This is given for the pre-operative period and enables the units to obtain the term loans and working capital from financial institutions/banks under priority sector lending.

- Obtaining facilities for land, accommodation and other approvals

- Obtaining important NOCs from regulatory bodies like Labor Regulations and Pollution Control Board.

Permanent Registration Certificate

- Income Tax and Sales Tax Exemption as per State Govt. Policy

- Concessions and Incentives in Power Tariff

- Purchase and Price preference for the goods produced

- Raw material availability depending upon existing policy

- Permanent registration of tiny units should lawfully be updated after 5 years

For facilitating the process of the promotion and for increasing the competitiveness of Micro Small and Medium enterprises the registration in accordance with Small and Medium Enterprises Development (MSMED) Act 2006 is conducted.

What Are Micro, Small And Medium Enterprises?

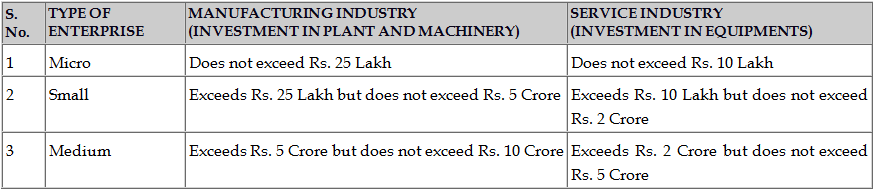

The following slabs comes under the MSMED Act for determining the status of the Enterprise:

Classes Of Enterprises That May Qualify For Registration

All the enterprise classes, Association of persons, Proprietorship, Partnership firm, Hindu undivided family, Company or Undertaking can apply for the registration and relish the privileges under the Act.

Whether The Registration Is Mandatory/Compulsory?

- The medium enterprise has to register compulsory under MSMED Act if engaged under production activity. For other Enterprises the registration is optional.

- It is recommended to all the enterprises to opt for the registration considering the benefits available under Act 1.

- Micro, Small and Medium (MSM) Enterprises registration under MSMED Act is a powerful medium to enjoy the privileges.

Micro And Small Enterprises:

- Easy Financial assistance from the Banks without collateral requirements

- Protection against payment delay from the buyers and interest rate on delayed payment

- Procuring Government Tenders preferable

- Octroi benefit and Stamp Duty

- Electricity bill concession

- Manufacturing / production sector enterprises Reservation Policies

- Time bound dispute resolution with Buyers through arbitration and conciliation

- ISO Certification Expenses Reimbursement

Medium Enterprises:

- Easy Financial assistance from the Banks without collateral requirements

- Procuring Government Tenders preferable

- Manufacturing / production sector enterprises Reservation Policies

- Time bound dispute resolution with Buyers through arbitration and conciliation